Share

0

/5

(

0

)

One can definitely feel lost when listening to the dialogue of professional traders. At a glance, they are using familiar words, but without knowing the meaning of special terms, you will never understand what they mean, for example, when talking about Fill or Kill.

One crucial aspect of the trading field is understanding the diverse orders available. These orders are instructions you give to your broker to buy or sell a security, such as a stock, Forex pair, or commodity.

Let's explore the most common order types, their functionalities, and when to use them effectively.

Key Takeaways

Knowing the types of orders in trading is critical for managing risk and optimising trade entries and exits.

The Forex order types allow traders to capitalise on currency price movements while maintaining control over their positions.

Observing the order book can help anticipate price movements and adjust trading strategies accordingly.

What Is an Order in Trading?

In simple terms, an order is a trader's instruction to a broker or trading platform on how to execute a trade. It can involve buying or selling an asset (such as stocks, bonds, commodities, or cryptocurrencies) at a specific price or market value.

Orders specify the trade details, including the asset to be traded, the quantity, and the price at which the trade should be executed. They are the foundation of all trading activity and help traders implement strategies in fast-moving markets.

Traders typically rely on various types of trading orders to manage risk and optimise profits. They allow traders to define how and when they want their trades executed.

Basic Order Types

There are several types of orders in trading, each designed to meet different strategic goals. Let’s discuss the most commonly used types.

Market Order

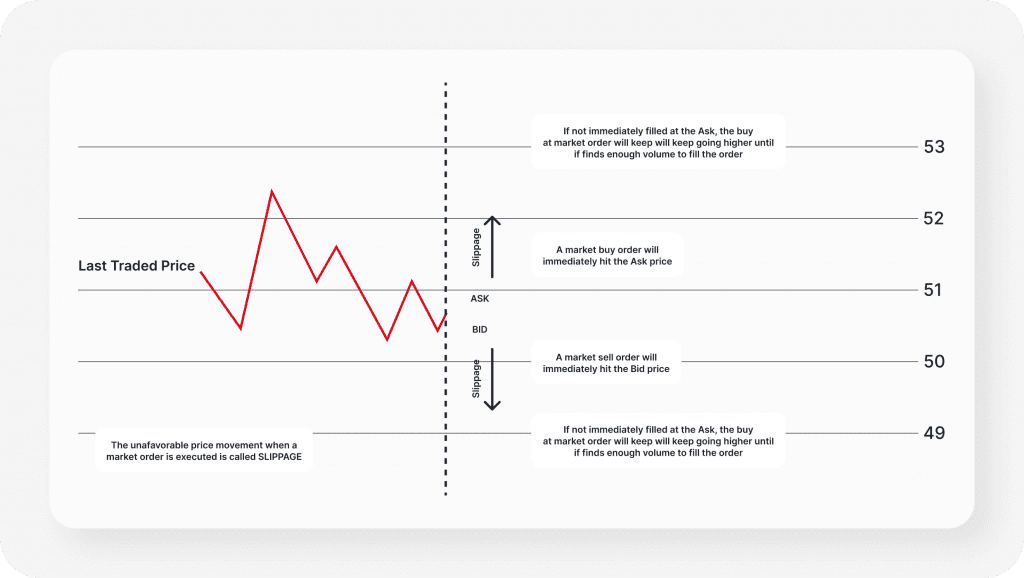

A market order is the most straightforward type of trade order. It is an instruction to buy or sell an asset immediately at the best available price. It is executed as soon as the order reaches the market, with the trade occurring at the current market price. This is ideal for traders who prioritise speed over price.

The primary advantage of a market order is its speed, ensuring swift execution, which is critical in fast-moving markets where traders want to enter or exit positions quickly. However, this immediacy comes with the downside of potential price slippage, particularly in volatile markets where prices can fluctuate rapidly between the time the order is placed and when it is filled.

Market orders are best suited for situations where securing the trade is more important than the exact price, such as when a trader needs to react quickly to market events or avoid missing a trading opportunity.

Limit Order

A limit order is an instruction to buy or sell an asset at a specific price or better, giving traders greater control over the execution price. The order will only be filled if the market price reaches the specified or more favourable price. For example, if a trader wants to buy a stock at $50 but it's currently trading at $55, they can set a limit order to execute the trade only when the price drops to $50.

There are two types of limit orders: a buy limit order, which sets the maximum price at which a trader is willing to buy, and a sell limit order, which sets the minimum price at which they are eager to sell.

The key advantage of limit orders is that they allow traders to execute trades at precise prices, ensuring they do not pay more or sell for less than intended. However, the downside is that it may not be filled if the market doesn't reach the set price, potentially missing the opportunity.

Limit orders are best used by traders who prioritise price precision over immediate execution, such as those looking to buy or sell at specific target levels.

Advanced Order Types

Now, let's look at more advanced orders used in trading.

Stop-Loss Order

A stop order, commonly known as a stop-loss order, is an instruction that converts into a market order once a specified price, known as the trigger price, is reached. This allows traders to automatically enter or exit a position when the market moves to a certain level. It is mainly used to prevent excessive losses in a trade and is a vital tool for managing risk and protecting your capital.

There are two types of stop orders: a buy stop, which is set above the current market price and is triggered when the stock price rises to that level, and a sell stop, which is placed below the current market price to trigger when the price falls.

The main advantage of a stop order is its ability to manage risk by limiting potential losses, as it automatically activates when the market moves against the trader's position. However, since it becomes a market order once triggered, it can result in price slippage, where the final execution price differs from the trigger price due to market volatility.

Stop orders are particularly useful for traders looking to protect profits or limit losses without constantly monitoring the market. It's essential for all trading strategies, especially for beginners, to control downside risk.

Stop-Limit Order

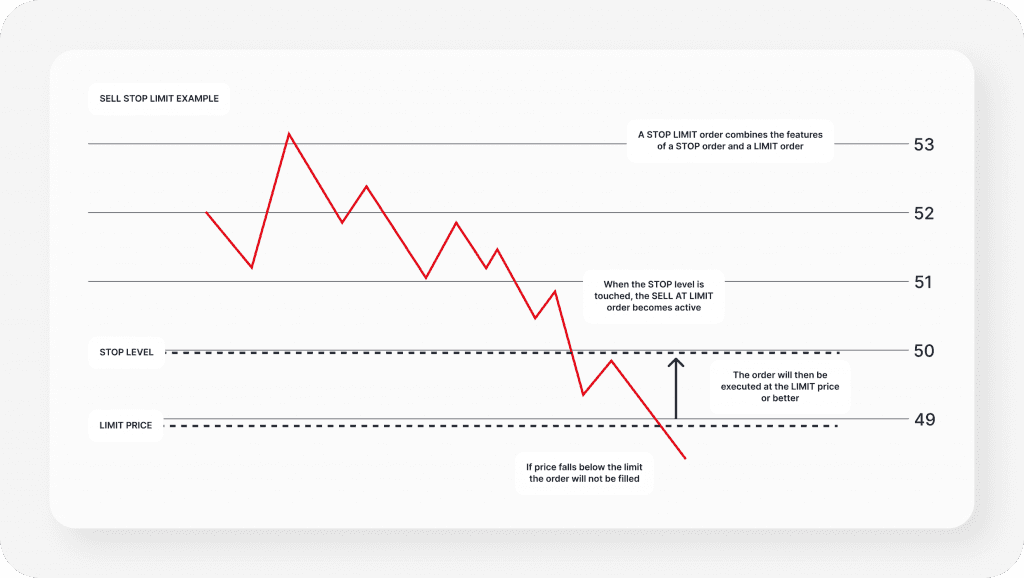

A stop-limit order merges the features of both stop orders and limit orders, providing traders with more precise control over trade execution. Once the stop price is reached, it turns into a limit order, meaning the trade will only be executed at the specified limit price or better.

This type of order gives traders the advantage of setting a price ceiling or floor, offering more control than a regular stop order, which executes at the market price once triggered.

However, the downside is that it may not be filled if the market price surpasses the limit price, potentially leaving the trade unexecuted during rapid market movements.

Stop-limit orders are ideal for traders looking to manage risk by limiting potential losses while still maintaining control over the exact price at which the order is fulfilled.

Iceberg Order

An iceberg order is a trading strategy involving concealing a large trade's total size. Breaking down the order into smaller, visible portions helps avoid significant market disruptions and current price fluctuations that can occur with large, immediate orders.

Institutional investors often use this strategy to execute large trades more discreetly and potentially less disruptive, allowing them to minimise their market impact and avoid attracting unwanted attention to their trading activities.

Trailing Stop Order

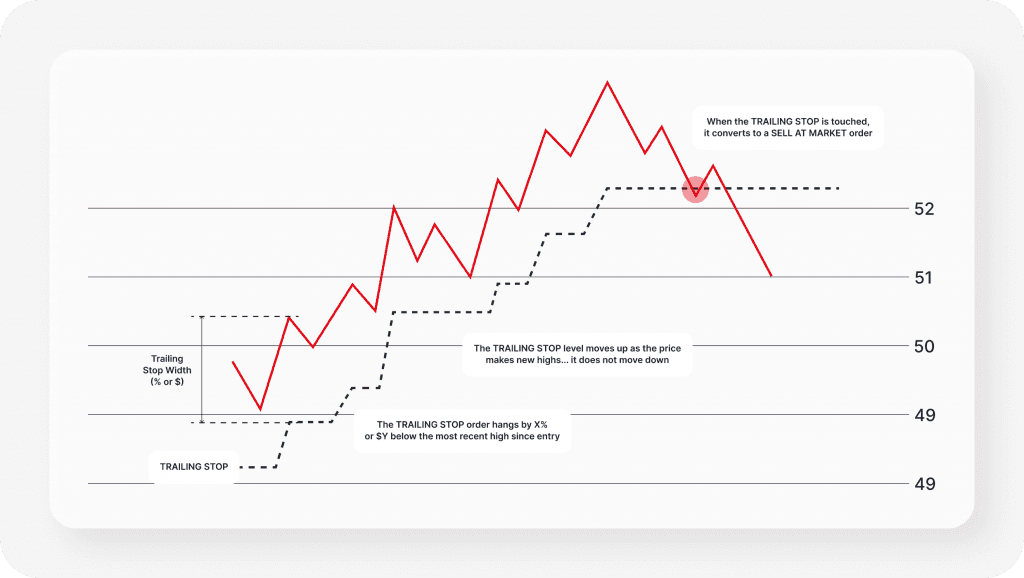

Trailing stop is a dynamic type of stop order that automatically adjusts as the market price moves in the trader's favour. It works by trailing the market price at a set distance, which can be defined as a percentage or a fixed dollar value.

As the asset's price rises (for a long position) or falls (for a short position), the stop price moves accordingly, allowing the trader to lock in gains while the market continues to move in its favour.

The primary advantage of a trailing stop order is that it enables traders to capture profits without needing to constantly monitor the market, letting winners run while limiting downside risk. However, the order can be triggered by short-term market volatility, potentially leading to an exit earlier than intended.

Trailing stop orders are best suited for traders looking to take advantage of market trends while still securing profits if the market reverses direction.

Fill or Kill

A fill-or-kill (FOK) order is an instruction that requires an order to be fully executed immediately or cancelled entirely if it cannot be completed at once. FOK ensures that no partial fills occur, meaning the entire asset quantity must be bought or sold instantly, or the order is voided.

The primary advantage of FOK is that it guarantees complete execution or no transaction, which can be critical for traders who require exact quantities for their strategies. However, if the market cannot fulfil the entire order instantly, the trade is cancelled, potentially missing an opportunity.

FOKs are best suited for large traders or institutions who need complete and immediate execution without dealing with partial fills that could disrupt their position or strategy.

Immediate or Cancel

An immediate or cancel (IOC) order must be executed immediately but allows partial fulfilment. Any portion of the order that cannot be filled immediately is cancelled.

The main advantage of IOC is that it ensures that at least part of the trade is executed immediately. However, if liquidity is low, the portions of the order may not be filled.

IOCs are ideal for traders looking for quick execution but who are willing to accept partial fills.

Good Till Cancelled

A good till cancelled (GTC) order is a type of order that remains active until it is either executed or explicitly cancelled by the trader. Unlike other orders that may expire after a set time period or at the end of the trading day, GTC stays open indefinitely, allowing traders to maintain their position without constant market monitoring.

The primary advantage of GTC is its suitability for long-term trading strategies, as it provides flexibility and persistence in reaching a desired price level. However, the potential downside is that the order can remain pending for an extended period, sometimes leading to it being forgotten or overlooked.

GTCs are handy for long-term traders or investors who want to buy or sell at a specific price point and do not need to manage the order daily.

All or None

An all or none (AON) order must be executed in its entirety or not at all, but unlike FOK, AON orders are not subject to immediate execution. They remain active until the order can be fully filled or the order expires.

AON guarantees complete execution at the desired price, but the order may remain unfilled for a long time or possibly not at all, especially in illiquid markets.

AONs are helpful when the trader needs the entire trade to be completed at once to avoid slippage or partial fills.

Specific Types of Forex Orders

The order types discussed above are equally applicable to Forex trading. However, some platforms may offer additional order types specific to Forex, such as:

One-Cancels-the-Other (OCO) Order

OCO combines two linked pending orders (buy or sell). If one order is executed, the other is automatically cancelled.

This order type is useful for creating complex trading strategies, such as placing a limit order to enter a trade and a stop-loss order to protect profits.

If-Done (IFD) Orders

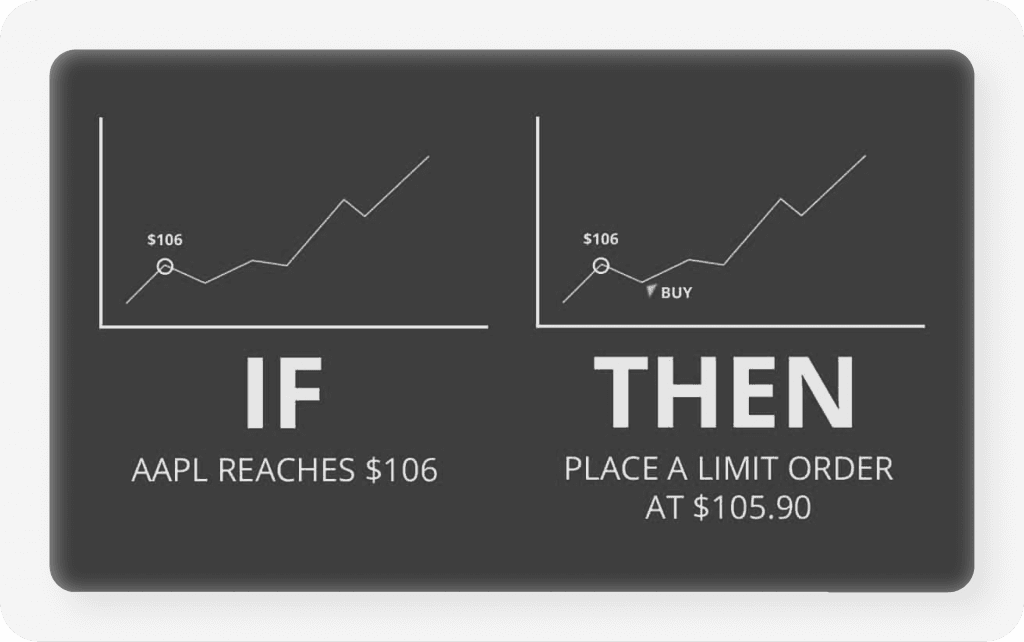

It is a conditional order that is only executed if a specified order is filled first. IFD is often used to automatically place a profit-taking or hedge order after executing an initial trade.

Understanding the Trading Order Book

The trading order book is a dynamic record of all buy and sell orders for a particular security. It shows the bids, offers, and the volume of each order at various price levels. By analysing the order book, traders can gauge market sentiment, liquidity, and potential price movements.

The more orders in the order book, the more liquid the market is. Market depth refers to the volume of buy and sell orders beyond the best available prices, offering insight into potential market strength.

The order book shows the spread between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). A narrow spread often indicates a highly liquid market.

Conclusion

Knowing the different types of orders in trading is crucial for any trader, from beginners to experienced investors. By mastering these tools, you can effectively manage risk, execute trades at desired price levels, and capitalise on market opportunities. Remember to choose the order type that best aligns with your trading methods, risk resistance, and market circumstances.

Read also